Bank of St Helena Enhances Safe International Transfers Via SWIFT

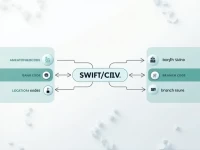

The SWIFT code BHELSHJJXXX for BANK OF ST. HELENA is an essential tool to ensure the security of your funds during international remittances. By understanding its address, function, and importance, you can confidently carry out each cross-border transaction and enjoy a safe and swift money transfer service.